Chapter 6 of Home Buying In 30 Minutes discusses the importance of home inspectors and appraisals when buying a house, condo, or multifamily property. The following post explains the home inspection vs. appraisal differences. Getting an accurate assessment of the condition of a structure before you buy it is an essential, but your lender has its own interests in mind which is where appraisals come into play.

You want an experienced and thorough inspector who will check out the property after the offer is made (and accepted) and before the purchase and sale agreement (P&S) is executed. Many people caution buyers against seeking home inspection referrals from real estate agents, since they want to see the deal close quickly.

On the other hand, your real estate agent is supposed to be working toward your best interests. If you are comfortable that your agent is doing that, then ask for a referral. After all, he or she has likely worked with most of the local inspectors and knows them fairly well.

In the meantime, after your offer has been accepted, your mortgage lender will order an appraisal. Just like the inspection, you have to pay for the appraisal. An appraiser will visit the property, walk through the structure, check out the comparable properties (recent sales of similar properties in the local market), and report back to the bank what they think the fair-market value of the home is.

Lenders require appraisals to protect themselves in case things go badly. For instance, if a buyer falls in love with a property and pays too much money for it, the lender may have to sell at a lower price, and will therefore be unable to recover their loan.

What’s the difference between a home inspection and appraisal? Source: Depositphotos

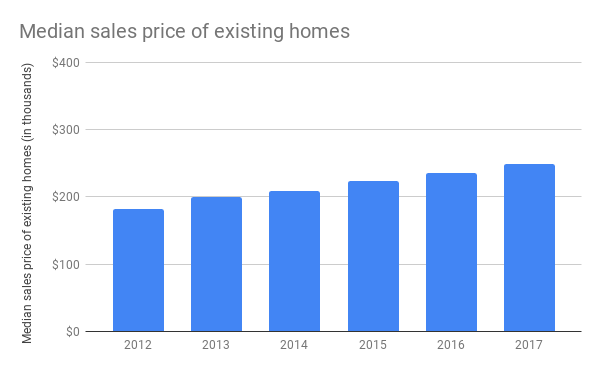

But what if you really, really want that house? Let’s say you’ve agreed to pay $250,000 for a property, but it is only appraised at $225,000. You can challenge the appraisal if you think the appraiser made a mistake. Perhaps he or she got the number of bedrooms wrong, or compared the house to sales from three years ago. These kinds of mistakes are uncommon, but they happen.

Typically, if the property is appraised for less than the agreed-upon price, there is a clause in your offer that allows the buyer to withdraw from the deal without penalty.

However, if you really want the home and are willing to pay above-market value for it, there is another option. The lender may still be willing to loan the buyer 80 percent of the value of a home worth $225,000, or $180,000. If you are motivated and can scrape the funds together, you can put $70,000 down and still pay the $250,000 offer price with the $180,000 loan — either a standard 30-year mortgage, or a special mortgage product like a 5/1 ARM.