In Chapter 4 of Home Buying In 30 Minutes, I described how some buyers might want to get an adjustable-rate mortgage (ARM) — a loan product that offers low introductory rates that are later adjusted based on current interest rates. While ARM rates can adjust either up or down, since rates are currently near historic lows and are widely expected to rise, you can expect the payments on an ARM to increase over time. Below I will describe how ARMs work and what is a 5/1 ARM.

Most people’s incomes rise over time, too. If you think your income will increase enough to cover the cost of the higher payments in subsequent years, an ARM could work for you.

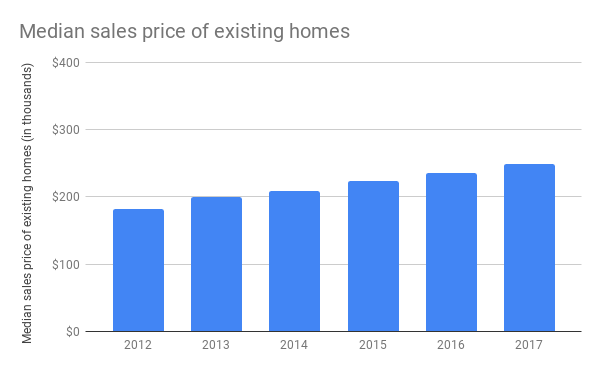

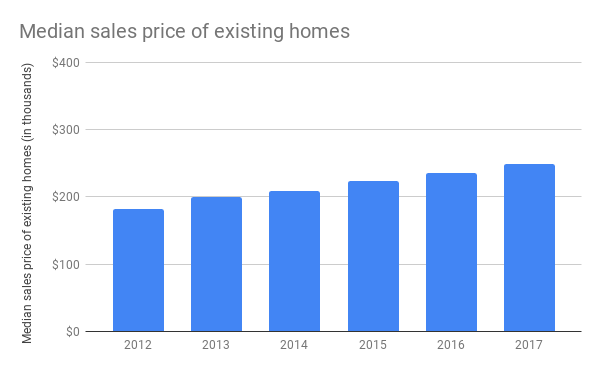

Home pries have been rising in the U.S., but so have interest rates, which means ARMs can adjust to much higher rates for people holding them. Source: NAR

On the other hand, payments in an ARM can rise substantially over the life of the loan. The lower initial payments are attractive to buyers, but they come with the risk of much higher payments later. This is especially true in a rising interest rate environment like the one we’re currently in.

ARMs can be a good choice for first-time buyers who don’t plan to own the property for more than a few years. Of course, if plans change and they wind up owning the property for longer than expected, they might be able to refinance into a fixed-rate mortgage before the ARM payments balloon.

A 5/1 ARM means the introductory interest rate remains constant for the first 5 years of the loan. After that, the interest rate changes (either up or down) no more than once per year. A 3/6 ARM means the rate is fixed for 3 years, and thereafter adjusts every 6 months. Typically, there is an annual cap (meaning the interest rate can’t go up or down more than a certain percent in any given year) and a lifetime cap (meaning the rate can never exceed a certain range, regardless of what the index does). There are also 7- and 10-year adjustable rate ARMs.