Homes require a lot of maintenance and it can be expensive, so it makes sense to start saving. If the roof on your house is going to have to be replaced in 10 years and will cost $15,000, you’ll need to save $125 per month to cover the cost. Water heaters and dishwashers tend to last about 10 to 15 years, while HVAC systems can fail without warning. There’s no landlord to call when something breaks, so it’s smart to start budgeting for repairs and maintenance.

Interest rates are constantly fluctuating, so when you first meet with a mortgage broker and she tells you she can get you a 6 percent interest rate on a 30-year mortgage, that rate is only good for today. If it takes you 6 months to find a property, rates could have risen or fallen significantly by then. You won’t know the actual rate you’ll be paying until you lock it in, which can be free or cost a few hundred dollars depending on how long you want to lock the rate for.

Typically, buyers will lock in an interest rate shortly after signing the P&S and a closing date has been agreed to. The rate should be locked at least until the closing date, because that’s when you officially take out your mortgage.

However, you don’t have to lock in your rate after signing the P&S. If you think rates will drop between the P&S and the closing, you could wait to see if rates go down. There’s a risk—rates might go up! If they go up significantly and you’re already stretching your finances, it could put your deal in jeopardy. For this reason, I suggest leaving interest rate predictions to professional investors, and lock in the mortgage after the P&S.

Chapter 6 of Home Buying In 30 Minutes discusses the importance of home inspectors and appraisals when buying a house, condo, or multifamily property. The following post explains the home inspection vs. appraisal differences. Getting an accurate assessment of the condition of a structure before you buy it is an essential, but your lender has its own interests in mind which is where appraisals come into play.

You want an experienced and thorough inspector who will check out the property after the offer is made (and accepted) and before the purchase and sale agreement (P&S) is executed. Many people caution buyers against seeking home inspection referrals from real estate agents, since they want to see the deal close quickly.

On the other hand, your real estate agent is supposed to be working toward your best interests. If you are comfortable that your agent is doing that, then ask for a referral. After all, he or she has likely worked with most of the local inspectors and knows them fairly well.

In the meantime, after your offer has been accepted, your mortgage lender will order an appraisal. Just like the inspection, you have to pay for the appraisal. An appraiser will visit the property, walk through the structure, check out the comparable properties (recent sales of similar properties in the local market), and report back to the bank what they think the fair-market value of the home is.

Lenders require appraisals to protect themselves in case things go badly. For instance, if a buyer falls in love with a property and pays too much money for it, the lender may have to sell at a lower price, and will therefore be unable to recover their loan.

What’s the difference between a home inspection and appraisal? Source: Depositphotos

But what if you really, really want that house? Let’s say you’ve agreed to pay $250,000 for a property, but it is only appraised at $225,000. You can challenge the appraisal if you think the appraiser made a mistake. Perhaps he or she got the number of bedrooms wrong, or compared the house to sales from three years ago. These kinds of mistakes are uncommon, but they happen.

Typically, if the property is appraised for less than the agreed-upon price, there is a clause in your offer that allows the buyer to withdraw from the deal without penalty.

However, if you really want the home and are willing to pay above-market value for it, there is another option. The lender may still be willing to loan the buyer 80 percent of the value of a home worth $225,000, or $180,000. If you are motivated and can scrape the funds together, you can put $70,000 down and still pay the $250,000 offer price with the $180,000 loan — either a standard 30-year mortgage, or a special mortgage product like a 5/1 ARM.

In Chapter 4 of Home Buying In 30 Minutes, I described how some buyers might want to get an adjustable-rate mortgage (ARM) — a loan product that offers low introductory rates that are later adjusted based on current interest rates. While ARM rates can adjust either up or down, since rates are currently near historic lows and are widely expected to rise, you can expect the payments on an ARM to increase over time. Below I will describe how ARMs work and what is a 5/1 ARM.

Most people’s incomes rise over time, too. If you think your income will increase enough to cover the cost of the higher payments in subsequent years, an ARM could work for you.

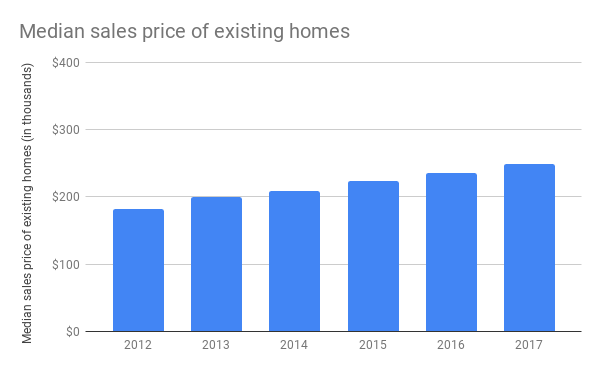

Home pries have been rising in the U.S., but so have interest rates, which means ARMs can adjust to much higher rates for people holding them. Source: NAR

On the other hand, payments in an ARM can rise substantially over the life of the loan. The lower initial payments are attractive to buyers, but they come with the risk of much higher payments later. This is especially true in a rising interest rate environment like the one we’re currently in.

ARMs can be a good choice for first-time buyers who don’t plan to own the property for more than a few years. Of course, if plans change and they wind up owning the property for longer than expected, they might be able to refinance into a fixed-rate mortgage before the ARM payments balloon.

A 5/1 ARM means the introductory interest rate remains constant for the first 5 years of the loan. After that, the interest rate changes (either up or down) no more than once per year. A 3/6 ARM means the rate is fixed for 3 years, and thereafter adjusts every 6 months. Typically, there is an annual cap (meaning the interest rate can’t go up or down more than a certain percent in any given year) and a lifetime cap (meaning the rate can never exceed a certain range, regardless of what the index does). There are also 7- and 10-year adjustable rate ARMs.

As I explained in Chapter 4 of Home Buying In 30 Minutes, few first-time homebuyers are able to buy a house or condo in an all-cash deal. Typically, a young couple will be able to afford a relatively small down payment (say, $20,000) and pay the remainder of the cost of the home (say, $200,000) using a type of bank loan called a mortgage. This post describes mortgages and requirements related to mortgages.

Second-time homebuyers moving into a larger home will be able to pony up larger down payments through the sale of their smaller first home, but will still need to take out a new mortgage (after paying off the remaining loan amount from the mortgage on the first home). If you are a downsizing empty-nester, or moving from an expensive market to an inexpensive market, you may be able to pay for the cost of the new home through the sale of your old home, maybe even with some cash left over!

Signing mortgage documentation

When planning to take out a mortgage, be prepared for banks to look at your credit score, recent tax returns, bank account statements, and pay stubs. They want to have confidence that you will be able to make the monthly payments, and may say “no” if they see something in your application that gives them pause.

If your home buying plans are still a few years out, you have some time to consolidate credit card debt, pay off some past-due utility bills, and reduce luxury purchases, which will positively impact your credit score. To see potential problem areas and correct errors in your score, request a copy of your credit report (free in many states) from one of the major credit bureaus: Experian, Transunion, and Equifax.

Remember that there may be other monthly costs associated with the purchase that can significantly impact your finances. They include local property taxes charged by the city or town, which can often be added to monthly mortgage payments. Other costs include fees charged by condo associations and planned communities, and certain types of insurance. These costs will vary according to the home you choose to buy and local factors.